Get T1036 Home Buyers Plan Gif. All the information you need on the cra t1036 tax form for the home buyers' plan in canada. In order to participate in the home buyers' plan, you must print off a copy of form t1036.

Approximate monthly payment is an estimate calculated with 20% down and 30 year fixed.

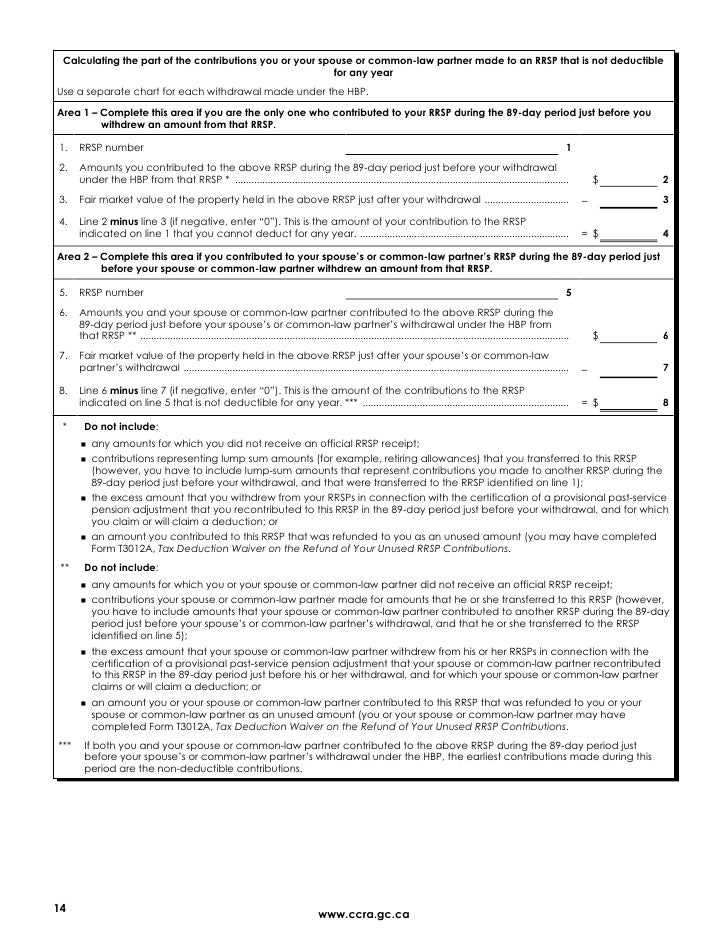

Form t1036, the home buyer's plan request to withdraw funds from an rrsp; The maximum that can be withdrawn from your rrsp under the hbp program is $25,000. The taxpayer must provide the address of the qualifying if, after withdrawing funds as a home buyers' plan withdrawal, circumstances change and you don't meet all the conditions, you can cancel your. Use this form to make a withdrawal from your registered retirement savings plan (rrsp) under the home year month day.